Credit Repair

Your Credit Information Report (CIR) plays a large part in the loan application process and hence a lower score can impact your chances for a loan approval. So if you have had a bad credit history and you want your CIBIL score to improve then it is very important to understand the options that you have. Going to a “credit repair” company and paying a large sum of money may not be the best solution. CIBIL is not associated with any credit repair company.

Usually, there are 2 major issues with a CIR:

- Inaccurate information reflecting on the CIR

- Defaults on the payment caused either due to :

- Genuine financial hardship

- Missed payments on credit cards due to relocation internationally/ domestically

- Missed payments on non-receipt of statement

- Disputes with the lender on account of charges or annual fees

- Disputes with the lender on account of fraud

Before we proceed to suggest a course of action, it is important to understand and go through your credit report in detail.

FOLLOW THE BELOW STEPS:

1. BUY SCORE

Buy your CIBIL Score and Credit report. This will cost you only Rs. 550/- and you can have access to the credit report within 3 business days.

2. CHECK CREDIT REPORT

Follow the below step by step process to understand your report and identify areas to improve on.

Check how many open accounts there are on your report. There are 2 issues you could face:

- The account has not been reported “closed” by the lending institution

- There are open accounts which are not yours

This can be easily remedied by following CIBIL’s Dispute Resolution Process. Incorrectly stated open accounts overstate your credit exposure.

- Check the status of the accounts

A “written off” or a “settled” account can be viewed negatively by the lender. Check if there is any account which has been tagged incorrectly. If yes, raise a dispute via CIBIL’s Dispute Resolution Process.

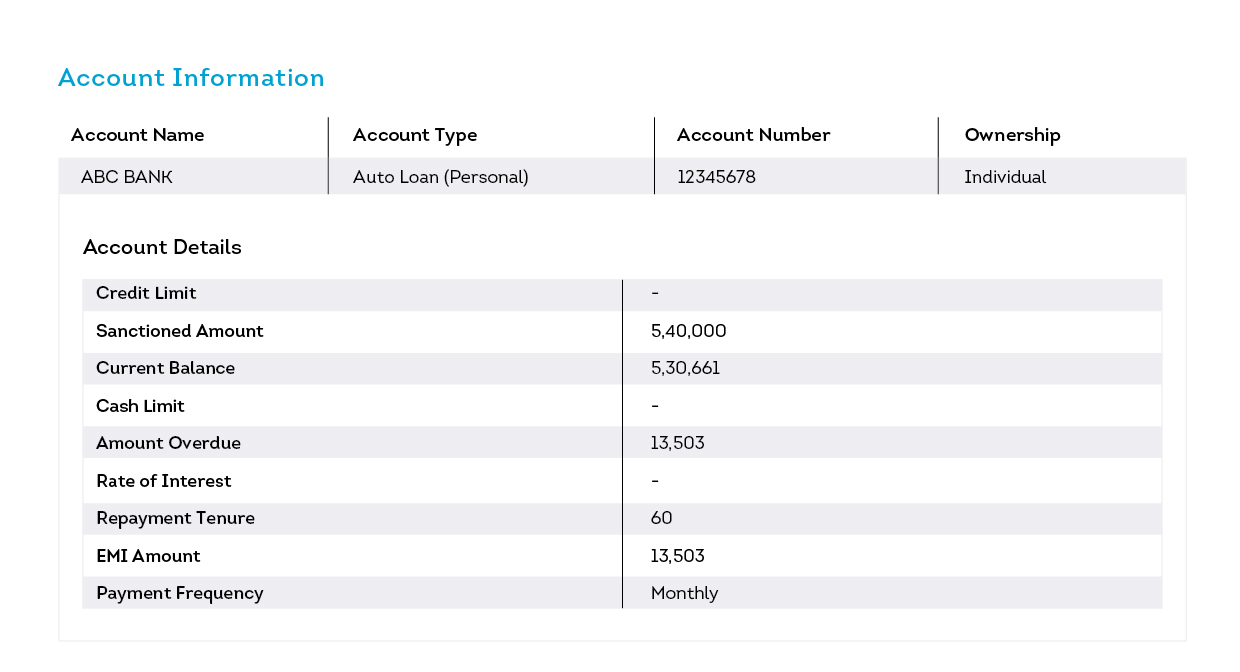

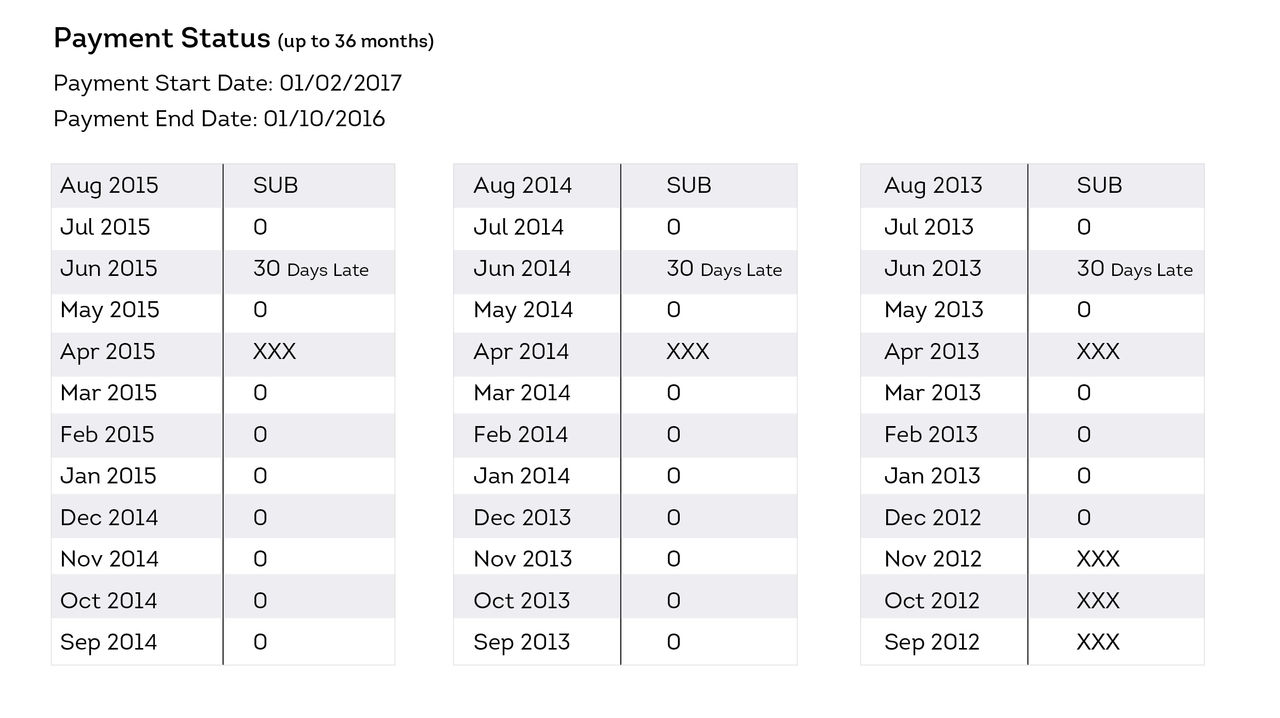

- Check the payment history of every account

Go through the Days Past Due section carefully. If you notice anything apart from a “000” or an “XXX” then this can be viewed negatively. If you missed some payments, then ensure you pay your bills/EMIs diligently. Your CIBIL Score will begin to improve. You need to wait at least 6-8 months before you can see a positive impact on your score (provided everything else is continues without an adverse change)

3. INITIATE ACTION

To understand the remedial action that should be taken in the afore-mentioned situations, let’s take each example and see what the best alternative solution is:

- Inaccurate information reflecting on the CIR

Once you have identified the inaccurate information, initiate the dispute resolution process by clicking here. You should hear back from CIBIL in 30 days. If the respective bank or financial institution re-confirms that the information that was reflecting in your CIR is correct then we will not be in a position to make any changes. It is advisable to get in touch with the concerned Bank directly to expedite the process.

- Defaults on the payment caused either due to:

- Genuine financial hardship

If for any reason you missed your payments earlier because of a loss of job or other unforeseen circumstances, then it is advisable to pay back the amount to the bank when your financial situation is better. A clean credit history will enable you to enjoy better credit terms in the future.

- Missed payments on credit cards due to relocation internationally/ domestically

When you are relocating, it is not only prudent to transfer bank accounts or close accounts where necessary, but also manage open loans and credit cards. If the EMI payment is linked to a savings account, then ensure that either that account is not closed (and is adequately funded) or the standing instruction for the EMI debit is transferred to another active account. But in the midst of all this, many a times we miss informing the credit card issuer about the relocation in advance which results in missed payments, late payment fees and other service charges which then snowballs in to a large amount. In such a case, the best solution is to repay the full amount because it is your responsibility to ensure that your dues are paid in full.

- Missed payments due to non-receipt of statement

The terms and conditions of most credit card issuers clearly states that the cardholder is obliged to pay the outstanding amount irrespective of the receipt of the statement. Non-payment due to non-receipt of statement may not be considered a valid reason for missing payments (If this has been covered in the cardholder agreement). If you have not paid the outstanding due to this then the late payment fees, service charges etc would be accumulating. The sooner the issue is resolved, the better will it be for your credit history. It is advisable to get in touch with the bank and work out an optimal solution

- Disputes with the lender on account of charges or annual fees

Before taking up any credit card or loan, one should always go through the terms and conditions thoroughly. One should always enquire about the charges (one time and recurring) such as maintenance charge, fees, issuance charge, processing charge, penalties, interest rates, transfer charges, pre-closure charges etc.

- Disputes with the lender on account of fraud on your credit card

In case of fraudulent transaction, the bank will investigate the matter and depending on the findings a charge back may or may not be issued. Such disputes need to be resolved between you and the Bank so as to ensure your credit history is not/minimally impacted.

- Genuine financial hardship

QUICK CREDIT FACTS:

A credit repair service cannot remove or edit any information in your CIBIL credit information report directly.

If you authorize a credit repair company to apply for a credit information report on your behalf we will (to ensure confidentiality) send the report to your email address provided or home address. Your credit information is confidential information and should not be shared freely.

You can opt for CIBIL’s online dispute resolution process free of charge.

We cannot make any changes in your credit report directly. The respective bank or financial institution should authorize us to make the changes.